Sunday, March 31, 2019

I'm going all in

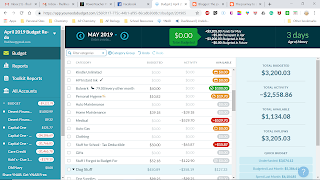

I made it to payday without anything bouncing. I actually had $78 left in the bank. I sat this afternoon (when I should have been working) and revamped my budget. I started a whole new one with all the categories I need. I put in some that will cover the car registration next year and our car insurance premium in full in 6 months. I have categories for fun money for each of us as well as vacation and savings. This is what my budget looks like:

I think I have included everything that happens in our month. I have the dog's supplements and treats. I have their wellness plan. I have the pest control which happens every other month, so I split the cost between 2 months. I am fairly certain I have everything covered. That's kind of what I used the last 2 months for, finding all the expenses that happen and I forget about. So I think I'm good with the budget.

Then I sat and entered all the recurring transactions into the check register. By making them recurring, I not only keep track of what is coming up so I don't miss a bill, but I can project what the money will be as the month progresses. Here is what April looks like:

It's hard to see, but if you look at the end of April (the top) you will see that we will end the month with $528 left over. What you don't see, because it's not there, is there is another paycheck before the end of April. It shows the paycheck on the 11th, but it doesn't show the paycheck on the 25th. That means we are going to be ending April with almost $2500 extra. Say what??????? Now, as far as I know, we have no major bills or expenses coming up in April so this should be true. In fact, most of the time when I've projected it's been fairly accurate. So I believe this may well happen. This means that by the end of May we may be a full month buffered. We get some bonus money when school ends and that will only help the situation. I am trying not to get excited, but OMG!!!!!! Could this actually work? Is it possible to stop living paycheck to paycheck? I am cautiously optimistic about this whole thing. I just need to keep myself in check and not go on a spending spree because there is money in the bank.

I have cut ties with Netflix, Sling, and Hulu. I no longer have any of that. We are using strictly cable streaming. It was a little rough getting started, but I think we have worked the kinks out. I like it because my one TV didn't get Sling - at least not well - and I really like watching Travel Channel or the History Channel.

I think the real goal here is to be mindful of the money. We lived for so long on autopilot. Bills would come in and we had no money to pay them. Payday would come and we would pay those bills and then be broke until next payday. Rinse, repeat endlessly. I don't want to live like that. I want to have enough buffer in the account so that I can set all bills on autopay and forget it. I want to not have to worry about money and how much we have. I think we are going to be able to do this. I really and truly do.

Saturday, March 23, 2019

Saving more money

Continuing yesterday's theme... I cut my Sprint bill by $30 but I will have to pay about $10 for Hulu, so really only cut it by $20. Then went and turned off the sports on Sling since football is over and cut that by $10.00. So I was at a $30/month savings. Not earth shattering but good.

Then, as I'm leaving work yesterday, I get a call from a number I don't know but I answered it anyway (rare for me). It was Cox offering me a streaming deal. I currently have my internet through Cox and it's about $120/month. Add to that Sling, $44 (new price), Netflix, $1150 and going up I believe, plus the new Hulu charges, $10, and I was paying about $185.50/month for TV. And we have to switch between different things to watch different things. So we go on the antenna for local TV, the Fire Stick for Sling, etc. It can get annoying. And we don't get all the channels with the antenna, at least not in all the rooms of the house. The deal with Cox is I get internet, streaming TV of over 200 channels, including all the local stuff, for $165/month. A savings of about $20. Add that to my now savings of $30 with Sprint and I'm at $50 a month. Not bad. Plus, I don't have to remember to pay 4 different things, it's all in one place. So I'm kind of proud of myself. We'll see how it goes. We have a month to cancel and there is no contract so technically we can cancel anytime. If we don't like it we'll just go back to Sling/Netflix/Hulu.

I think the important part here is to realize that just because that's what's been done, we don't have to continue to do it that way. I can look around and change things if I can find a better way. So the real success is being open to change and looking for new and different ways to cut expenses.

Friday, March 22, 2019

The road is never straight

While this is true for many, if not most, things in life, it is especially true for me trying to get financially right. I started off with, I'm going to pay $800 a month towards my debt and get out of debt in 16 months. Then it became, I'm going to pay $100 a month and not create any more debt and get out of debt in 2 years. Now it's like, I'm just trying to keep my head above water here......

It's been a rough couple of months since I started YNAB and while I know it's not YNAB's fault, I can't help but wonder what it would be like if I hadn't started YNAB. So let's recap:

December - started YNAB mid-December with the goal of paying off all debt in about 16 months

January - went well with YNAB, realized that debt payment was too aggressive and needed to scale it back a bit.

February - the wheels came off the bus. I overspent significantly and spent the rest of the month trying to recover.

March - some bills came due that while not unexpected, I didn't really have the money to cover and now we are really, really tight.

This experience can't help but make me wonder a couple of things. First, are we living beyond our means? Do we need to scale back in some areas, somehow? Second, is my spending that out of control that I throw the budget out of whack every month? Third, when will I get a true handle on our budget and have things covered as they need to be covered?

I was thinking about contacting Sprint and seeing if there is any way to cut our bill there. That bill is $225 a month. If I could get that below $200 I would be excited.

I just got off a chat with Sprint and was successful. I got my bill below $200 so that's all good. I now have to pay for Hulu again, but I'm good with that. I also just changed my Sling subscription since football is over there is no need for the Sports Extra package anymore. So I'm down about $50 a month so far. Yay me.

Sunday, March 17, 2019

YNAB Broke

People in the YNAB community say that they are YNAB broke. That means that your money is doing a job and isn't available to waste. That's a good thing and we are most definitely YNAB broke this week. In fact, we are so broke I'll be juggling a couple of bills just to make sure we get through the pay period. But that's okay. I like knowing exactly where we are and not checking the bank account and being shocked every time. So it's good.

Last post I wrote about a $19.99 charge that was showing in the bank and I didn't know what it was for. It completely disappeared. I don't know what it was for. It was there and then it was gone. Interesting. Now I have a $79.00 charge that I'm not sure what it's for. It's been there for a couple of days and I don't know where it came from. So I will wait to see what happens with that one. It's nice to be so on top of the money that I can see something like this immediately. Love it.

It's weird to think that I spent so much of my life not having any idea how to handle money. Living paycheck to paycheck was so normal I did not see how to do it any other way. I have tried so many different budgets and money strategies in the past but I always ended up in that paycheck to paycheck cycle. I just did not see how to get out of it. Why isn't the YNAB way of budgeting and handling your money more common? Why doesn't someone teach this to people? I just feel like so many people I know live in the paycheck to paycheck world and don't see how to get out. I know people personally that would live like that and not see a problem with it. That's the way it's done. In fact, I know people who live like that, have gotten lots of money, and because they really don't know how to handle money blew through it really rather quickly. Not that I'm an expert or could even help them at the time, but looking back I see it and realize what was wrong. They didn't know any better. Oh well, one thing I have learned in my almost 60 years is that I can't change people, I can only change me. And I'm good with that.

So in spite of being YNAB broke, I'm not stressing about money. I paid my car registration - which I didn't plan for because I'm so new to YNAB - and that is basically what threw everything off. But it's paid and we will recover. Spring break is over and it's back to school next week, I spend no money during the school week. So things are good and I'm going to continue to say that.

Tuesday, March 12, 2019

I need to keep better track

I keep having these mystery deductions from my account and it's driving me crazy. I know I don't have a solid habit of adding transactions to my YNAB right away, but I also don't go out much and can usually remember what I did from one day to the next. I have a $19.99 charge on my account and I don't know where it came from. UGH!!!! The problem with my bank is that it shows as pending but doesn't have a name so I have to wait until it clears to actually see what it is. UGH!!! So frustrating. And so annoying that this keeps happening. Of course, in my defense, the last few have not been me but charges I did not know were coming. So that's all good. Now I just have to watch the account to make sure I know what this is for. It is frustrating.

In other news, payday is almost here, all my bills have been paid and I have a few dollars left. That is so nice. To not be sweating hoping the paycheck clears before the bills do. It's nice to have a little cush. Alright, when I figure this out I'll come back and update this post.

In other news, payday is almost here, all my bills have been paid and I have a few dollars left. That is so nice. To not be sweating hoping the paycheck clears before the bills do. It's nice to have a little cush. Alright, when I figure this out I'll come back and update this post.

Sunday, March 10, 2019

3 months in

So I started this journey with YNAB in mid-December. That makes 3 months since I started. It's been a rough 3 months, but I think I have a handle on things. Though I won't let down my guard until it becomes a habit. But I can see and feel things changing in me. I realized how I was looking at things wrong before. Let me explain.

Before I would get paid and I would sit and pay my bills. Then if I had money left over I thought I could just spend it. Then we would be broke until next payday and would start the cycle again. I tried to get a handle on the finances, I really did. But I didn't know how to approach it so I just kept trying to do things the same way but to get different results. It didn't work. But I didn't realize this until I really screwed things up in February. I did the same thing I had always done. Got paid then went freaking crazy because I had some money left over. Well, I went way overboard and ended up in a hole. A very deep hole that took a long time to get out of. When I did get out of it, I swore that I would not do that again. I gave all my dollars jobs and the only ones that had any flexibility were the money in the just for fun fund. Everything else stayed exactly the same and I didn't touch it. I am now coming up on the 2nd paycheck in March and money is still where I put it. I'm very proud of myself and I think I finally understand how things are supposed to work. This has also changed how I view purchases. Today was the Arizona Aloha Festival. In past years, I would have bought a whole bunch of stuff I didn't need for reasons that I can't quite explain. Today we looked at all the places and I had sparks of 'oh, I want that' but I quickly got over most of them. The only thing I was seriously tempted by was a pair of Hawaiian material leggings with pockets on the side. I really like them but they were $40. I didn't like them that much.

So I guess things are going well. I wish I could budget more. It's a lot of hurry up and wait. We get paid, I budget, then I wait until next payday. So Thursday I get to play around again and pay some more bills. Hopefully I will continue to get this and do the right thing.

Before I would get paid and I would sit and pay my bills. Then if I had money left over I thought I could just spend it. Then we would be broke until next payday and would start the cycle again. I tried to get a handle on the finances, I really did. But I didn't know how to approach it so I just kept trying to do things the same way but to get different results. It didn't work. But I didn't realize this until I really screwed things up in February. I did the same thing I had always done. Got paid then went freaking crazy because I had some money left over. Well, I went way overboard and ended up in a hole. A very deep hole that took a long time to get out of. When I did get out of it, I swore that I would not do that again. I gave all my dollars jobs and the only ones that had any flexibility were the money in the just for fun fund. Everything else stayed exactly the same and I didn't touch it. I am now coming up on the 2nd paycheck in March and money is still where I put it. I'm very proud of myself and I think I finally understand how things are supposed to work. This has also changed how I view purchases. Today was the Arizona Aloha Festival. In past years, I would have bought a whole bunch of stuff I didn't need for reasons that I can't quite explain. Today we looked at all the places and I had sparks of 'oh, I want that' but I quickly got over most of them. The only thing I was seriously tempted by was a pair of Hawaiian material leggings with pockets on the side. I really like them but they were $40. I didn't like them that much.

So I guess things are going well. I wish I could budget more. It's a lot of hurry up and wait. We get paid, I budget, then I wait until next payday. So Thursday I get to play around again and pay some more bills. Hopefully I will continue to get this and do the right thing.

Thursday, March 7, 2019

Holding my own

Things have just been chugging along. All my bills are paid. I have money in the bank. I have money set aside for some bills that will come due in the next paycheck period. We call that funding ahead. Some people can fund ahead a month or two or even six. I was super excited that I could fund slightly ahead for the next pay period. Baby steps I guess.

One thing that has really been bothering me is how much I spend on that stupid Klondike game. I have spent $60 in March so far and it's only the 7th. At this rate, I'll spend over $300 this month on this game. So I'm going to set myself a monthly budget for this game and that's it. Also, I removed my payment methods on Facebook so that I can't just click buy. I will actually need to enter a credit card to buy anything, Better.

I had wanted this month to just be setting things right. Make sure nothing bounces and kind of figure out what my budget amounts need to be going forward. That's working pretty well, I just get annoyed having to keep moving things in my budget. It's not like I have to move the money in real life, just move the money around to different jobs. I guess it's okay, it's all a learning process.

I'm anxious to get my tax refund - that still hasn't arrived - and to get our next paychecks. I like this budgeting thing and I want to get further in my budgeting journey. I want to get a couple of good months under my belt and really see how this thing works.

Okay, I'm in class and we are watching a video so I should get back to paying attention.

Friday, March 1, 2019

The light at the end of the tunnel

Is most definitely not a train.

Yesterday was payday and today Hubby's retirement came in. I made out checks for the mortgage (it's been sold) and the homeowner's dues, plus I paid Mavy's next class on Wednesday - all with checks. That is the most checks I've written in years. This morning I sat down to budget the rest of the money and an amazing thing happened. I covered everything that needed to be covered and I had leftover money. what, what????? That has not happened in so long I can't even remember. So, I put some money in an emergency fund. Still had extra. So I budgeted so we could go out to eat 1 time each weekend until next payday. Still had extra. So I budgeted for the fancy harness I want to get Mavy. Still had extra. So I started budgeting for the bills that will be due next payday. I'm budgeting ahead. Say what?????

Since I started YNAB I've seen people posting about how they are budgeting current money into future months. So they get paid today but the money won't actually be used until March or in some cases April, May, even June. I had no idea how that was possible and how you got to that point. I just couldn't see it happening for me. Like I'm some special case. But now I see how that can happen. Instead of paying all my bills and saying, I have $600 left over, let's blow it. I pay all my bills and then earmark that $600 for the end of the month's bills. Then when the next paycheck comes, I already have some bills budgeted for. That reduces how much I will use from that paycheck and allow me to budget for the coming month. Gradually the amount to budget forward will get larger and larger and pretty soon we will get paid and I won't even care because all the bills are paid already and we are not spending that money for another month. OMG!!! I honestly thought that in order to make this happen, ever, I would need a huge windfall of money. That's not true. You just need to pay attention and be purposeful with your money. On paper we make a lot of money, far more than we need each month, I just couldn't figure out how to get ahead. Now I totally get it. The best part of this whole thing is, I have a tax refund check coming in and I don't need it at all. That has absolutely never happened.

This whole thing feels like a huge weight has been lifted off my shoulders. I feel lighter than I've felt in years and years. I also see now how these things really are all related. In the past, I had always viewed getting straight with money as something I did and then finished. Uh, no! It doesn't work that way. It is an ongoing, continuous process that I need to work on all the time. Just like a healthy lifestyle. It's not something you get and then stop, you have to keep working at it. I really and truly get it now.

Subscribe to:

Posts (Atom)

Changing the mindset

So the hardest part of this whole YNAB thing is changing the mindset. I've mentioned this before but it's really coming up in the la...

-

I keep having these mystery deductions from my account and it's driving me crazy. I know I don't have a solid habit of adding tran...

-

Is most definitely not a train. Yesterday was payday and today Hubby's retirement came in. I made out checks for the mortgage (i...

-

So I started YNAB (You Need a Budget) in mid-December. I had spent months and months trying to budget our money and not doing a great job...