I have very solid, specific goals that I want to achieve in the next few years. First, I want a house with some land. I would prefer if it's not in an HOA but even that part is negotiable. But I want some land. I would like an acre but will settle for 1/2 an acre. It has to have a pool, that is not negotiable. Then I want to get myself a car. I'm really leaning towards a Jeep because I've always wanted one, but I might change that. But we only have 1 car. We've only had 1 car for 3 years. And while 90% of the time it is fine, sometimes I just want to have my own wheels and be able to go where and when I want. I'm also becoming enamored of a cabin in the mountains. I would love a small place where we could escape for the weekends. Nothing fancy, just a small place on a little bit of land. Somewhere we could walk and do things with the dogs. I also want to travel, but that is becoming less and less important and I'm not sure why.

So I have all these goals and I want to start working on them. But I can't. Until I get a really good grip on our finances, I have to just kind of go with the flow. It's bugging me. I want to do something to make progress to move forward towards my goals. But I have to be patient because I saw what happens when I do things without proper planning. So it is one step at a time of me, but I'm not really a patient person.

With Hubby's tax refund, we went to Costco and stocked up on all the things we were short of. We like to go to Costco during the weeks we get paid and somehow we had gotten off track from that. So we bought enough things to last 3 weeks so we will be back on our payday cycle for Costco. The funny thing is I knew exactly what we were doing. I thought it out carefully and realized it was the best way to go long term. But still going through Costco and buying all that stuff was nerve-wracking. When the total came up as $302 I almost fainted. Now, pre-YNAB I never would have thought twice about that. I would have said, it's fine. We had the money to cover it in the bank and Hubby's tax refund will clear on Monday so it's all good. But now, knowing in such detail our financial situation and my goals and such, I was sweating it. I guess that's a good thing. Being nervous about spending money, even if we have it, is a good thing. I spent far too long not caring about spending money. Definitely time for a change.

Sunday, February 24, 2019

Saturday, February 23, 2019

On being broke.....

So we had no money. Zero. Zilch. Nada. Zip. I was juggling when to pay what bill so that I didn't overdraw the checking account. I hate, hate, hate paying NSF fees, that is literally throwing your money out the window. Anyway, I paid the Internet on the day it was due and the electric on the day it was due (thank God for online payments) and was trying to decide when to pay the water and the gas. We had to take the car in for service yesterday and wanted to go to Red Robin's while we waited. I had some cash and said we could not eat more than the cash we had. So we had a beer, some onion rings, and some wings. Came to $30 and that was good. Then the car needed some small repairs which we had to put on the credit card. We knew we had to run to Costco today because the dogs are out of food, Hubby has money put away to cover that. When we finally got home yesterday afternoon, I sat down to check the budget - something I do every day now - and discovered that Hubby's tax check had hit. Woo Hoo!!!!! That's means we have slightly more the penny shown above to get through the week. Now comes the hard part of how to use it the best possible way. It is extra money and as such, I don't want to use it on just regular things. But, since we were so broke, this can be used to help us get right again. As I stated in the last post, I was running out of the dog's pills, the CBD oil, and I ran out of the tablets to clean my night guard (gross). So I could use this to restock everything and then when we get paid next week money won't have to go towards that stuff. I guess that makes the most sense. I want to be in a stable financial position and using this money to get caught up on things would be the best way to do that. We will be getting mine also and I'm assuming that will be soon, so we can use that and what is left of Hubby's to do some buffering or debt paydown. Okay, that makes the most sense. Then when payday hits next week, I don't really have anything to use the money for, just the mortgage. Okay, talked myself through that little nightmare. I have goals. I want to progress towards those goals. Sometimes I have to consider that actually taking 1 step back will create greater forward momentum.

Wednesday, February 20, 2019

Really broke or just paying more attention?

so we are really and truly broke. Like the only money we have is the cash in our pockets. We do not have enough money to pay the bills and I will be juggling the money until we get paid again. Which happens to be in another week. We are out of pills for the dogs. I'm running out of CBD oil. We are running out of dog food. Seriously!!! We have not been this broke in a long, long time. Or have we??? Is it just because I'm paying so much attention and that I have a goal in mind - getting out of debt - that makes me so hyperaware? I am trying to remember what has happened in the past. I'm sure that we have been in situations like this before, but because I wasn't paying this close of attention, I don't think I ever felt this way. The good point is that I'm going to make sure this never happens again. Ever. Ever.......

On another note, because we are so broke, I thought of looking for a personal loan. The thought being that I would pay off the credit cards and then just have one payment to make. Then I looked at the numbers. I would borrow $10,000 at 11.75% interest. Payments would be $346 and I would have it paid off in 36 months. Sounds good. Until I looked at my payment plan. In the plan I'm doing, I would be paying about $400 a month, the effective interest rate is 10.6% and they will all be paid off in 30 months - that's 6 months earlier. It is slightly more interest paid, $2000 vs $1100, but I will have done it all on my own. There is a whole lot to be said for doing it on your own. I think it will be a whole lot more effective in keeping me from using my credit cards if I struggle to pay them off. I want to get to the point where I put things on my credit card and go home and pay it off. Seriously. I want to carry no balance from month to month. So there are times when I think the struggle is so worth it and this might be one of those time.

On another note, because we are so broke, I thought of looking for a personal loan. The thought being that I would pay off the credit cards and then just have one payment to make. Then I looked at the numbers. I would borrow $10,000 at 11.75% interest. Payments would be $346 and I would have it paid off in 36 months. Sounds good. Until I looked at my payment plan. In the plan I'm doing, I would be paying about $400 a month, the effective interest rate is 10.6% and they will all be paid off in 30 months - that's 6 months earlier. It is slightly more interest paid, $2000 vs $1100, but I will have done it all on my own. There is a whole lot to be said for doing it on your own. I think it will be a whole lot more effective in keeping me from using my credit cards if I struggle to pay them off. I want to get to the point where I put things on my credit card and go home and pay it off. Seriously. I want to carry no balance from month to month. So there are times when I think the struggle is so worth it and this might be one of those time.

Saturday, February 16, 2019

It's really all one problem

Over on the YNAB Facebook page, someone made a post about something, but one line struck me hard. "What if you budgeted your time like you budget your money?" Whoa!!! I kind of knew this because I am a planner junkie, but having someone else say it just really hit me. We only have a finite number of hours in a day, like we have a finite number of dollars. Using them wisely and making them work for you is super important. I think it's time to start thinking like this all the time about everything.

On another topic, it came to me this morning that I don't know how to handle money because I was never taught. My parents lived paycheck to paycheck. I saw that and that's what I learned. I'm not faulting them, they did the best they could with what they had, but I can only learn what I see and that's what I learned. By watching them I learned that payday was an event. We would cash checks, go shopping, have a big meal, maybe even buy a treat. So payday took on this huge significance that it really shouldn't have. It should be just another day. If you are handling your money right, payday is just another day and not any real special event.

Which leads me to food. I had to learn that certain foods did not have any special, magical powers. Cake or cookies did not hold the key to my happiness. Eating them did not transform my life into something special. I have been working extremely hard to change the way I think about certain foods. Cookies cannot cure all my problems. Nor are they special enough to be eaten when I'm feeling happy. Or sad. Or angry. Or melancholy. Or depressed. Or ecstatic. Or any other feeling. Food should not be related to feelings at all. It's just food. It just nourishes your body. That's it.

So I believe that all of these seemingly diverse topics, boil down to one problem. How I look at things. I look at time as not having enough and that I will feel a lot better if I waste some. Stupid. I look at money as something that can't just sit but will make me feel better if I spend it. Stupid. I look at food as something that will make me feel better to eat. Stupid. I need to change the way I view things. Meditation is helping me see that many things go on in my mind and have nothing to do with reality. Time to start looking at these things as things that can work for me and not necessarily make me happy. Time for a change in my thought process.

Friday, February 15, 2019

Sins of the past

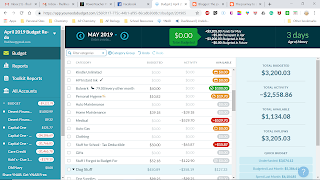

So I started YNAB (You Need a Budget) in mid-December. I had spent months and months trying to budget our money and not doing a great job. Then I stumbled across UnDebtit. This allows you to enter all your debt and helps you figure out a way to pay it off. You have to have some extra income to put towards the debt, but even a little bit will get you out of debt if you have a solid plan. I liked this a whole lot. I like to be able to see what is going where and when it needs to go. They have a calendar that shows when your bills are due. Well, here is a picture of it:

Initially, I was very, very angry with myself, and I still am a bit. But I have decided that I need to use this as a learning experience. In January, because things were going so well, I got cocky and thought I didn't need to check the budget/bank account every day. I also thought I could remember everything I bought in my head - that never works. Ever. So things got out of control rather quickly. So now, I am checking the budget/bank account every day and making sure things are on track. I don't have enough money to pay the bills, so I'm having to be creative. But, and this is super important, I will get through this and I will not let it happen again.

My initial plan was to jump in and start paying things off. I had the mortgage set to pay an extra $125 a month. I used UnDebtIt to work out credit card payoff using $800/month extra. And then got crazy when I ran out of money. Hello!!!! So basically I was committing to almost $1000 a month on top of all our bills. Well, that was destined to fail. Of course, if I hadn't spent $800 on unplanned things, it might have worked for a while. Regardless, the plan now is to take a step back. Every payment is now down at the minimum. I'm going to stay there for a month or two to just see how our expenses play out. Once I have a true handle on our real month expenses, then I can use that data to figure out how to get us out of debt. I am also building a category in right now to cover unexpected things. I'm putting $25.00 a paycheck in there. That way when things do come up, I will have a little bit of money to cover it. The plan is that unexpected things will come up less and less often as I get a handle on this budgeting thing.

So there we are. That's where I'm at today. Came out guns blazing and got shot in the foot. Time to rest, recover, and regroup.

Thursday, February 14, 2019

What do I truly value?

So I decided to start this blog for a number of reasons.

A) I love blogging or journaling or whatever you want to call it. It really helps me think and organize my thoughts. It also helps me see things that may not be readily obvious. So yeah, I love writing.

B) I like to keep track of things and be able to look back and see how things have changed. Or not. Sometimes that happens and if I'm spinning my wheels, it's right there in black and white.

So yeah, I really like blogging and working out my thoughts this way.

So, money... I've never been really good with it. Never. I have a feast or famine relationship with it. If I have some I will spend it. If I don't have some I will stress. And I've decided that needs to end. I want to be in a position where money does not cause me stress. It can be done and I'm hoping that this blog will help me figure it out.

Back to the purpose of this post. I've been following a health and fitness guy, hate to say diet guy, who is insistent that in order to change your body for good, you need to change your mindset. You have to not place a lot of value on the things that are no good for you. If you place a lot of value on things like cookies and cupcakes, you are going to want them all the time, and it will be hard to resist them because they are valuable to you. Well, it occurred to me that it's the same with money. I put a high value on spending money or buying things, or whatever and so that makes dealing with money difficult. So it's time to change that.

What exactly do I value? As I get older I realize that time is what I value. Time doing things that I enjoy. Time playing with my dogs. Time with my husband. Time...... So what I need to do is focus my energies on things that will allow me more time to do what I really want to do. So here is a list of things I really want to do......

A) I love blogging or journaling or whatever you want to call it. It really helps me think and organize my thoughts. It also helps me see things that may not be readily obvious. So yeah, I love writing.

B) I like to keep track of things and be able to look back and see how things have changed. Or not. Sometimes that happens and if I'm spinning my wheels, it's right there in black and white.

So yeah, I really like blogging and working out my thoughts this way.

So, money... I've never been really good with it. Never. I have a feast or famine relationship with it. If I have some I will spend it. If I don't have some I will stress. And I've decided that needs to end. I want to be in a position where money does not cause me stress. It can be done and I'm hoping that this blog will help me figure it out.

Back to the purpose of this post. I've been following a health and fitness guy, hate to say diet guy, who is insistent that in order to change your body for good, you need to change your mindset. You have to not place a lot of value on the things that are no good for you. If you place a lot of value on things like cookies and cupcakes, you are going to want them all the time, and it will be hard to resist them because they are valuable to you. Well, it occurred to me that it's the same with money. I put a high value on spending money or buying things, or whatever and so that makes dealing with money difficult. So it's time to change that.

What exactly do I value? As I get older I realize that time is what I value. Time doing things that I enjoy. Time playing with my dogs. Time with my husband. Time...... So what I need to do is focus my energies on things that will allow me more time to do what I really want to do. So here is a list of things I really want to do......

- Buy a house with some land

- Work agility with Maverick

- Go to lunch/dinner when I want to

- Travel

All of those things cost money. So if I want to make them come true, I need to make my money do what I want it to and work for me. I know it can be done, I just need to buckle down and do it. And I need to change my mindset. I'm thinking of setting up a rule of not buying anything immediately. Anything over $10 has to wait 2 days and then I have to decide if I really want it or not.

People with way less money than I have are able to do amazing things, I just need to focus on what I truly value and not what I want in the now.

Subscribe to:

Posts (Atom)

Changing the mindset

So the hardest part of this whole YNAB thing is changing the mindset. I've mentioned this before but it's really coming up in the la...

-

Is most definitely not a train. Yesterday was payday and today Hubby's retirement came in. I made out checks for the mortgage (i...

-

I keep having these mystery deductions from my account and it's driving me crazy. I know I don't have a solid habit of adding tran...

-

So I started YNAB (You Need a Budget) in mid-December. I had spent months and months trying to budget our money and not doing a great job...