So the hardest part of this whole YNAB thing is changing the mindset. I've mentioned this before but it's really coming up in the last few days and I feel the need to talk it out. So it is just so hard to come to terms with 'being broke' when there is money in the account. For that matter, it's hard to come to terms with the budget when it doesn't seem to match with the bank accounts. Let me explain:

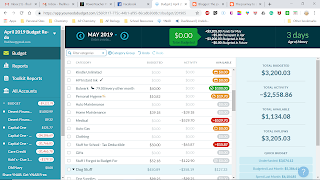

Here is what my budget looks like:

This is just a piece of my budget. Notice the various categories I have, like Kindle Unlimited, HP Ink, and Bulwark. Notice also that some are orange, some are green, and some are red. The green means that I have money put aside for this bill but haven't spent it yet. The orange means that I have a bill coming up but haven't put any money aside for it. The red means that I spent money that I haven't budgeted for. So the medical and the stuff for school have not been budgeted for so they will show up in red until I 'cover' them from somewhere. The grey means that I have budgeted for it and spent it ao it's all good. The disconnect in my head happens because of this. I have not budgeted that money, but I have the money in my account to cover it. I know logically that I have given some money other jobs and that is why I don't have the budget to cover this, but it just is not completely clicking in my head. The real problem is that I won't ever completely buy into this until it clicks in my head. Once I can wrap my mind around exactly what is happening, then I truly will be all in. Right now, I'm going through the motions but not completely buying into this. I need some lightning bolt to hit me and make everything crystal clear. And now as I'm typing this it is starting to make more sense. I don't have the 'budget' to cover this payment and the only way I can cover it is to move money that I have set aside for something else. So it's like virtual envelopes. I put some money in the car insurance envelope but may need to take it because I don't have enough in the medical envelope. Oh my god, I think I'm getting it.

This is just like what we do every payday. We pull out $300 in cash and split it up into envelopes. Groceries get $200, Charlie gets $60, and I get $40. That's what we have until next payday. If the grocery money runs short, then Charlie will take some of his own money to cover it. So we don't look at the total amount we have, $300, we look at what is available in each envelope. So if I have $40, I can spend $40 but if I only have $20, that's all I have. OMG!!! I feel like such an idiot. It took me so long to get this. So now I have to move things around between 'envelopes' to cover this and then I will have to refill the envelopes tomorrow when we get paid. Okay, so if I'm going to pay something that I don't have an envelope for, I need to move the money from one of the other envelopes to cover it. I then have to make sure to refill that envelope when I get more money. Okay, I can live with this now - I think. Sometimes I just have to 'talk' it through to really get it in my head.

Wednesday, May 8, 2019

Tuesday, May 7, 2019

More successes with money

After my post on Sunday, I was trying to figure out what to do with the money we had gotten when the Hubby reminded me of an outstanding tax bill from Hawaii. We left Hawaii 3 years ago and the final year we ended up owing taxes. It was $700 and while I hated to pay it, it felt nice to have it taken care of and out of the way. Then last night I remembered we had a $500 bill from the dentist, so I paid that too. I hated the fact that I used almost all of our windfall on bills, but I was super excited that I hadn't blown the money and still had it to pay the bills.

I think back on the way I used to think and it just kind of boggles my mind. In the past, I would have gotten that money, $1300, and would have started planning what I could spend it on. I would have wanted to blow it on useless stuff (much of which I have laying around my house) and wasted it. This time was very different. I did want to purchase some agility equipment but rather than basing it on how quickly I could get it, I based it on what I actually wanted, what would work for our set up, and price. Not necessarily the cheapest but the best value for the price. So I did that and I am very proud of myself. I could have spent almost $200 on the few pieces that I wanted. Instead, I spent <$100 and will make some of it myself. I'm excited. And I'm proud of myself. Instead of going off and buying things on a whim, I really put some thought into it. Something that I didn't use to do.

On the note of buying things on a whim, I have a number of things around my house that I bought and do not use. Over the summer I'm either going to sell them or start using them. I'm thinking of the 2 little printers I have. One I got at a garage sale for $5 the other I paid almost $100 for and they both work pretty much the same. So maybe I'll sell one for $50. Or I'll come up with a good way to use them. I also have a photo negative scanner that I'm going to use this summer. One of my projects is to get those negatives scanned and decide what to do with the pictures. I'll probably have books made for the kids and us, but I'll see. The summer will be spent using the things I have and not buying new things. Between my new mindset and my new attitude toward money, I'm looking forward to the summer.

Sunday, May 5, 2019

WAMing

There is a term in the YNAB community - WAM. It loosely stands for whack a mole, but really means that when unexpected expenses pop up you move money around to cover it. It's good in that it teaches you to be flexible with your money, unlike some other budgeting programs. So it's good......but....

I have been using YNAB almost 5 months now. And overall it's been an amazing experience. I finally feel like I have a really firm handle on our money. I finally feel like I know what I'm doing with our money. I really love it. I have not had an NSF in 4-5 months. That is amazing. Also, I have not had to sweat the last few days until payday in a long time. That is amazing too. To know with absolute certainty that there is money there and it's not going anywhere. I love it. But........

Things keep coming up. Things I didn't necessarily account for...or think about....or consider. And it's starting to drive me crazy. For example, I have a whole budget category set up for the dogs. In there are treats for them, pills they need, Mavys class fees, all things like that. I have them broken into separate categories even. And I think that's where the problem arises, but I don't want to get ahead of myself. Here is what my dog category looks like:

As you can see, I have individual medications broken out for Bella and Lola, which I just realized I can combine into one category since they get them at the same time - every other month. Then I have the Amazon supplements that we get every month. The CBD oil which I'm not sure I can continue since it is so expensive and I go through a bottle every week and a half. Then I have Mavy's agility classes and his treats from Chewy, then the wellness plans for all 3, and finally the RunBuddy for Bella. When I break it up this way I need a category for everything that happens to them. Maybe I should just have a Bella, Lola, and Mavy category and calculate what they need each month and then fund that. Because this week I ordered Mavy some agility equipment and there is no category for that so where does it go? Also, he will be taking an extra agility class over the summer, where does that go? I think trying to be too detailed is going to kill me. I like details, but I also like things to be easy.

Maybe it's time to rethink and retool the budget again. I don't want to do a fresh start - again - but I'm not liking the categories and I hate having to keep adding categories especially for one time things. Time to think about this.

I have been using YNAB almost 5 months now. And overall it's been an amazing experience. I finally feel like I have a really firm handle on our money. I finally feel like I know what I'm doing with our money. I really love it. I have not had an NSF in 4-5 months. That is amazing. Also, I have not had to sweat the last few days until payday in a long time. That is amazing too. To know with absolute certainty that there is money there and it's not going anywhere. I love it. But........

Things keep coming up. Things I didn't necessarily account for...or think about....or consider. And it's starting to drive me crazy. For example, I have a whole budget category set up for the dogs. In there are treats for them, pills they need, Mavys class fees, all things like that. I have them broken into separate categories even. And I think that's where the problem arises, but I don't want to get ahead of myself. Here is what my dog category looks like:

As you can see, I have individual medications broken out for Bella and Lola, which I just realized I can combine into one category since they get them at the same time - every other month. Then I have the Amazon supplements that we get every month. The CBD oil which I'm not sure I can continue since it is so expensive and I go through a bottle every week and a half. Then I have Mavy's agility classes and his treats from Chewy, then the wellness plans for all 3, and finally the RunBuddy for Bella. When I break it up this way I need a category for everything that happens to them. Maybe I should just have a Bella, Lola, and Mavy category and calculate what they need each month and then fund that. Because this week I ordered Mavy some agility equipment and there is no category for that so where does it go? Also, he will be taking an extra agility class over the summer, where does that go? I think trying to be too detailed is going to kill me. I like details, but I also like things to be easy.

Maybe it's time to rethink and retool the budget again. I don't want to do a fresh start - again - but I'm not liking the categories and I hate having to keep adding categories especially for one time things. Time to think about this.

Subscribe to:

Posts (Atom)

Changing the mindset

So the hardest part of this whole YNAB thing is changing the mindset. I've mentioned this before but it's really coming up in the la...

-

There is a term in the YNAB community - WAM. It loosely stands for whack a mole, but really means that when unexpected expenses pop up yo...

-

In my last post, I talked about how I was going all in and really going to make April awesome as far as budgeting goes. I was going to end t...

-

While this is true for many, if not most, things in life, it is especially true for me trying to get financially right. I started off wit...