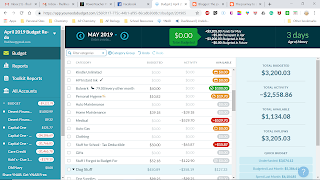

So I started YNAB (You Need a Budget) in mid-December. I had spent months and months trying to budget our money and not doing a great job. Then I stumbled across UnDebtit. This allows you to enter all your debt and helps you figure out a way to pay it off. You have to have some extra income to put towards the debt, but even a little bit will get you out of debt if you have a solid plan. I liked this a whole lot. I like to be able to see what is going where and when it needs to go. They have a calendar that shows when your bills are due. Well, here is a picture of it:

Initially, I was very, very angry with myself, and I still am a bit. But I have decided that I need to use this as a learning experience. In January, because things were going so well, I got cocky and thought I didn't need to check the budget/bank account every day. I also thought I could remember everything I bought in my head - that never works. Ever. So things got out of control rather quickly. So now, I am checking the budget/bank account every day and making sure things are on track. I don't have enough money to pay the bills, so I'm having to be creative. But, and this is super important, I will get through this and I will not let it happen again.

My initial plan was to jump in and start paying things off. I had the mortgage set to pay an extra $125 a month. I used UnDebtIt to work out credit card payoff using $800/month extra. And then got crazy when I ran out of money. Hello!!!! So basically I was committing to almost $1000 a month on top of all our bills. Well, that was destined to fail. Of course, if I hadn't spent $800 on unplanned things, it might have worked for a while. Regardless, the plan now is to take a step back. Every payment is now down at the minimum. I'm going to stay there for a month or two to just see how our expenses play out. Once I have a true handle on our real month expenses, then I can use that data to figure out how to get us out of debt. I am also building a category in right now to cover unexpected things. I'm putting $25.00 a paycheck in there. That way when things do come up, I will have a little bit of money to cover it. The plan is that unexpected things will come up less and less often as I get a handle on this budgeting thing.

So there we are. That's where I'm at today. Came out guns blazing and got shot in the foot. Time to rest, recover, and regroup.

No comments:

Post a Comment