Sunday, March 31, 2019

I'm going all in

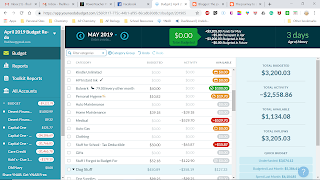

I made it to payday without anything bouncing. I actually had $78 left in the bank. I sat this afternoon (when I should have been working) and revamped my budget. I started a whole new one with all the categories I need. I put in some that will cover the car registration next year and our car insurance premium in full in 6 months. I have categories for fun money for each of us as well as vacation and savings. This is what my budget looks like:

I think I have included everything that happens in our month. I have the dog's supplements and treats. I have their wellness plan. I have the pest control which happens every other month, so I split the cost between 2 months. I am fairly certain I have everything covered. That's kind of what I used the last 2 months for, finding all the expenses that happen and I forget about. So I think I'm good with the budget.

Then I sat and entered all the recurring transactions into the check register. By making them recurring, I not only keep track of what is coming up so I don't miss a bill, but I can project what the money will be as the month progresses. Here is what April looks like:

It's hard to see, but if you look at the end of April (the top) you will see that we will end the month with $528 left over. What you don't see, because it's not there, is there is another paycheck before the end of April. It shows the paycheck on the 11th, but it doesn't show the paycheck on the 25th. That means we are going to be ending April with almost $2500 extra. Say what??????? Now, as far as I know, we have no major bills or expenses coming up in April so this should be true. In fact, most of the time when I've projected it's been fairly accurate. So I believe this may well happen. This means that by the end of May we may be a full month buffered. We get some bonus money when school ends and that will only help the situation. I am trying not to get excited, but OMG!!!!!! Could this actually work? Is it possible to stop living paycheck to paycheck? I am cautiously optimistic about this whole thing. I just need to keep myself in check and not go on a spending spree because there is money in the bank.

I have cut ties with Netflix, Sling, and Hulu. I no longer have any of that. We are using strictly cable streaming. It was a little rough getting started, but I think we have worked the kinks out. I like it because my one TV didn't get Sling - at least not well - and I really like watching Travel Channel or the History Channel.

I think the real goal here is to be mindful of the money. We lived for so long on autopilot. Bills would come in and we had no money to pay them. Payday would come and we would pay those bills and then be broke until next payday. Rinse, repeat endlessly. I don't want to live like that. I want to have enough buffer in the account so that I can set all bills on autopay and forget it. I want to not have to worry about money and how much we have. I think we are going to be able to do this. I really and truly do.

Subscribe to:

Post Comments (Atom)

Changing the mindset

So the hardest part of this whole YNAB thing is changing the mindset. I've mentioned this before but it's really coming up in the la...

-

So I started this journey with YNAB in mid-December. That makes 3 months since I started. It's been a rough 3 months, but I think I have...

-

There is a term in the YNAB community - WAM. It loosely stands for whack a mole, but really means that when unexpected expenses pop up yo...

-

Is most definitely not a train. Yesterday was payday and today Hubby's retirement came in. I made out checks for the mortgage (i...

No comments:

Post a Comment